To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests. By using this site, you are agreeing to security monitoring and auditing. You can request additional information via our

Info Request page or access our financial reports online by

clicking here. Below are the FFO amounts, dividends, and payout ratios for the last two quarters for LXP.

- Demand is still outpacing supply with vacancy at an all-time low leading to rental rates continuing to rise across the country.

- Below are the FFO amounts, dividends, and payout ratios for the last two quarters for LXP.

- You can request additional information via our

Info Request page or access our financial reports online by

clicking here.

We publish analysis and forecasts to help you choose the right strategies for trading LXP Industrial Trust stock today, tomorrow and in the future. In October 2013, Lexington Realty Trust acquired a portfolio of three parcels of land in New York. Lexington seeks to expand its industrial portfolio through build-to-suit transactions, sale-leaseback transactions and other transactions, including acquisitions. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

Lexington Realty Trust LXP.s

LXP’s common stock is listed on the New York Stock Exchange under the symbol “LXP”. For more detailed stock information, please

click here

to visit https://topforexnews.org/investing/stash-investing-review-overview/ our stock information page. The Barchart Technical Opinion rating is a 24% Buy with a Average short term outlook on maintaining the current direction.

When I last wrote about Lexington Realty Trust, I was enticed by the fact that growth looked to be resuming. I don’t think it offers attractive upside in the foreseeable future. Within the past month, LXP has climbed into the market cap sweet spot ($4B – $10B), by the skin of its teeth.

Other Stocks

LXP is an intriguing possibility for both growth and income, but for the time being, it is still unproven, and with so many great sizzling-hot Industrials to choose from, there is just no need to gamble on this one yet. Here is a side-by-side comparison, between LXP and 3 other Industrial REITs in the market cap sweet spot. To allow for equitable access to all users, SEC reserves the right to limit requests originating from undeclared automated tools. Your request has been identified as part of a network of automated tools outside of the acceptable policy and will be managed until action is taken to declare your traffic. To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option.

Form DEF 14A Ares Acquisition Corp For: Aug 01 – StreetInsider.com

Form DEF 14A Ares Acquisition Corp For: Aug 01.

Posted: Wed, 12 Jul 2023 20:54:20 GMT [source]

This is because although paid in Q3, the dividend value is usually declared during the previous quarter. FFO is a non-GAAP measure recognized by the SEC and provided by the REITs as a supplemental measure of their operating performance. FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT’s cash flow from operations. It is recommended to check the REIT’s website, Earning Reports and dividend announcements for the latest and updated information.

Analyst Ratings

For best practices on efficiently downloading information from SEC.gov, including the latest EDGAR filings, visit sec.gov/developer. You can also sign up for email updates on the SEC open data program, including best practices that make it more efficient to download data, and SEC.gov enhancements that may impact scripted downloading processes.

No HE with registered and office address at Spyrou Kyprianou 50, Irida 3 Tower 10th Floor, Larnaca 6057, Cyprus. LXP’s newly acquired Industrial facilities are not in bad locations, but other Industrial REITs are better positioned. Similarly, LXP is fairly new to the business of supply chain assets, and management has less experience and shallower roots in the industry than competitors in the Industrial REIT sector.

Investor Email Alerts

Nothing on this website constitutes, or is meant to constitute, advice of any kind. If you require advice in relation to any financial matter you should consult an appropriate professional. Lexington Property Trust has done an impressive job of transitioning its property portfolio towards the safer and growing https://currency-trading.org/education/how-to-trade-bullish-bearish-engulfing-candlestick-2021/ industrial segment. This transition is nearly complete, and LXP is starting to reap the rewards from increasing base rents with annual bumps . Considering the balance sheet quality and the relative undervaluation, I see LXP as offering the best value in the industrial REIT segment at the moment.

Shares of LXP Industrial Trust dropped 6.6% in premarket trading Friday, after the real estate investment trust, focused on single-tenant warehouse and distribution investments, said it has decided to suspend its evaluati… The new declared quarterly common share dividend, which will be paid in the first quarter of 2022 will be $0.12 per, representing an 11.6% increase over the prior quarterly dividend. Our intent to grow the dividend https://forex-world.net/brokers/xtb-review-is-xtb-a-scam-or-legit-forex-broker-2/ annually moving forward reflects our confidence in the direction of market rent growth and our opportunity to raise future rents. While LXP did cut the dividend back in 2019, it had more to do with LXP’s transition from higher yielding (but higher risk) office assets to lower yielding (but faster growing) industrial properties. Looking forward, I see room for dividend growth, as LXP’s portfolio transition is nearly complete.

Morgan maintained a Hold rating on LXP Industrial Trust (LXP – Research Report), with a price target of $11.00. Below is a simulation of how much money you would have made in dividends, and how much the shares would be worth had you purchased them 1 year ago for the amounts below. REITRating™ is REITNotes’ Real Estate Investment Trust industry-specific rating and ranking system. The overall score is out of ten points, with ten being the best score. The graph below plots the overall REITRating™ score for the last trading days. The website is operated and provides content by HF Markets (Europe) Ltd.

What is a REIT and how can I learn more about investing in REITs?

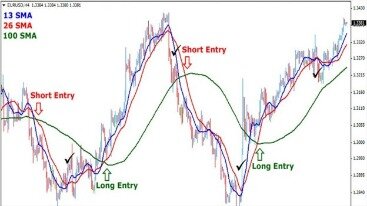

For example, a price above its moving average is generally considered an upward trend or a buy. It has taken 6 years, but the company has nearly completed its transformation from a polyglot Net Lease REIT to an Industrial REIT. At year’s end in 2015, LXP had a portfolio that consisted of only 16% warehouse and distribution facilities, with the rest distributed among a grab bag of manufacturing, cold storage, office, and other facilities.

- Lexington seeks to expand its industrial portfolio through build-to-suit transactions, sale-leaseback transactions and other transactions, including acquisitions.

- By the end of Q3 2021, the portfolio was 93% industrial, with office, manufacturing, and cold storage accounting for just 7%.

- You can also sign up for email updates on the SEC open data program, including best practices that make it more efficient to download data, and SEC.gov enhancements that may impact scripted downloading processes.

Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

Three years later, the mix was almost 50/50, with warehouse and distribution accounting for 48% of the portfolio by gross book value. By the end of Q3 2021, the portfolio was 93% industrial, with office, manufacturing, and cold storage accounting for just 7%. NEW YORK (MarketWatch) — Vornado Realty Trust said Tuesday that it will buy 8 million common shares of Lexington Realty Trust for $5.60 a share. The company said the shares were previously held by an affiliate of Apollo…

LXP Industrial Trust is a real estate investment trust, which engages in financing, acquisition, and ownership of portfolio of single-tenant commercial properties. Robert Roskind in October 1993 and is headquartered in New York, NY. Lexington Realty Trust is a publicly traded real estate investment trust. Lexington seeks to expand its industrial portfolio through build-to-suit transactions, sale-leaseback transactions and other transactions. Cash flow is improving over the past 3 years, but revenue has been checkered. It owns 134 properties in 30 U.S. states occupying a total area of over 5 million m².

Combined with the above-average Yield, this makes LXP attractive to income investors. The Dividend Score shown is based on the trailing 3-year dividend growth rate of (-12.23)%. But there is every reason to believe the dividend growth rate going forward will be positive, so the Yield 3 years from now should still be above average.